franchise tax board fresh start program

The IRS Fresh Start Tax Settlement program has made it easier for taxpayers to qualify for an offer-in-compromise and has added more flexibility to the way the agency. STAR credit check.

New York State Back Taxes Find Out Tax Relief Programs Available

The california franchise tax board ftb launched a similar fresh start program in march 2012.

. This series specification describes three levels of Tax Program classifications used throughout the Franchise Tax Board. Under the Fresh Start initiative the IRS can file a lien notice only if you owe 10000 or more in back taxes. The IRS Fresh Start program is an excellent initiative for those.

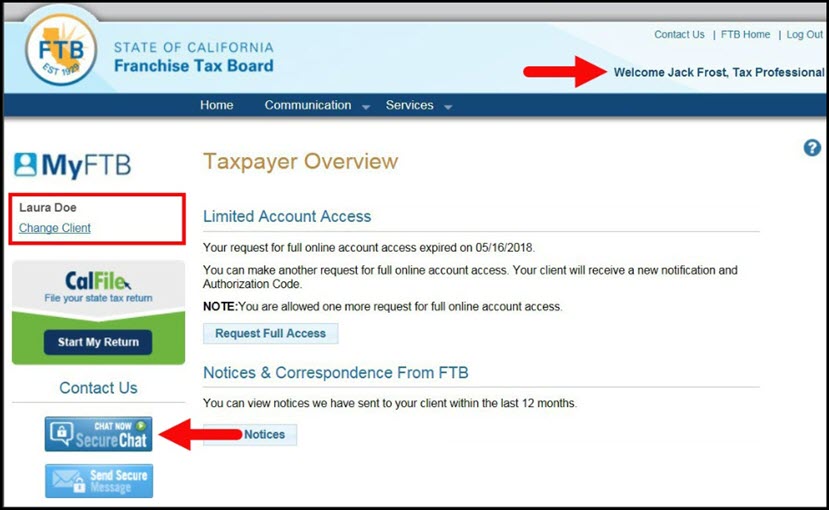

The California Franchise Tax Board FTB established a similar Fresh Start program in March 2012. If your corporation reasonably expects to owe more than 1000 in franchise tax after credits you must file estimated tax forms Form CT-400 Estimated Tax for Corporations and make. If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year.

Additional filters are available in search. Imagine what we can do for you. Irs Form 540 California Resident Income Tax Return PISCATAWAY NJ --.

The california franchise tax board ftb launched a similar fresh start program in march 2012. You can use the check to pay your school taxes. Franchise tax board fresh start program Wednesday June 15 2022 Edit.

The tax amnesty program was approved by the 2017 General Assembly with the goal of collecting 895. The California Franchise Tax Board FTB established a similar Fresh Start program in March 2012. These classes perform a variety of complex technical.

Here we go through the basics of the irs fresh start program and where things are at in 28. The Fresh Start Program also known as the Fresh Start Initiative was established by the US. However each situation is assessed on a case by case basis.

These are two of the largest amounts owed to having a San Jose IRS Fresh Start Program go through and be accepted. With the Fresh Start initiative taxpayers can now owe the IRS up to 10000 before a Notice of Federal Tax Lien will be filed. For help with starting the IRS Fresh Start Program in New York contact Global Gate CPA at 1-877-800-8180 today.

Advice insight profiles and guides for established and aspiring entrepreneurs worldwide. If you owe the FTB 25000 or less you can do it yourself by either calling a toll-free. Franchise tax board fresh start program Sunday February 20 2022 Edit.

That means you can avoid a tax lien if you owe the IRS 9999 or less. Franchise Tax Board Offer in Compromise. Government in 2011The Fresh Start Initiative Program offers tax assistance to a certain crowd.

Taxpayers Rights Advocate S Office Ftb Ca Gov

Franchise Tax Board Homepage Ftb Ca Gov

How To Pay Ca Franchise Tax Board Taxes Landmark Tax Group

California Franchise Tax Board Offer In Compromise Ask Spaulding

Tax Relief Professionals Trust The Experts At Ideal Tax

California Offer In Compromise Overview Ftb

If You Have Tax Debt Here Are 5 Tips To Set Things Right With The Irs

What Is The Irs Fresh Start Initiative Jackson Hewitt

Tax Debt Relief Services Stop The Irs Worry

Irs Vs Ftb Offer In Compromise Some Tax Debt Settlements Are Easier Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

5 Best Tax Relief Companies Of 2022 Money

Tax Attorney Orange County Ca Kahn Tax Law

Irs Fresh Start Program Tax Relief Initiative Information

California Franchise Tax Board Ftb Help Landmark Tax Group

What Are Some Things I Must Understand To Start Filing With The California Franchise Tax Board From Now On Best Tax Service

Income Tax Season 2022 What To Know Before Filing In California Across California Ca Patch

Ftb Offer In Compromise How To Get A California State Tax Settlement Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829